The club can now confirm its audited financial results for the year ended 30 June 2023.

This year included the play-off promotion success, with the best income performance on record, and the fourth year of self-sufficient funding without debt or shareholder financing.

We ended the year with £1.58m of cash in the bank (unchanged) and total debt levels reduced to £3m.

Key headlines to note are:

- Loss after tax: £665,000 (21/22: profit £33,000).

- Net cash in hand: £1.58m (21/22: £1.58m) at 30 June 2023. This is unchanged.

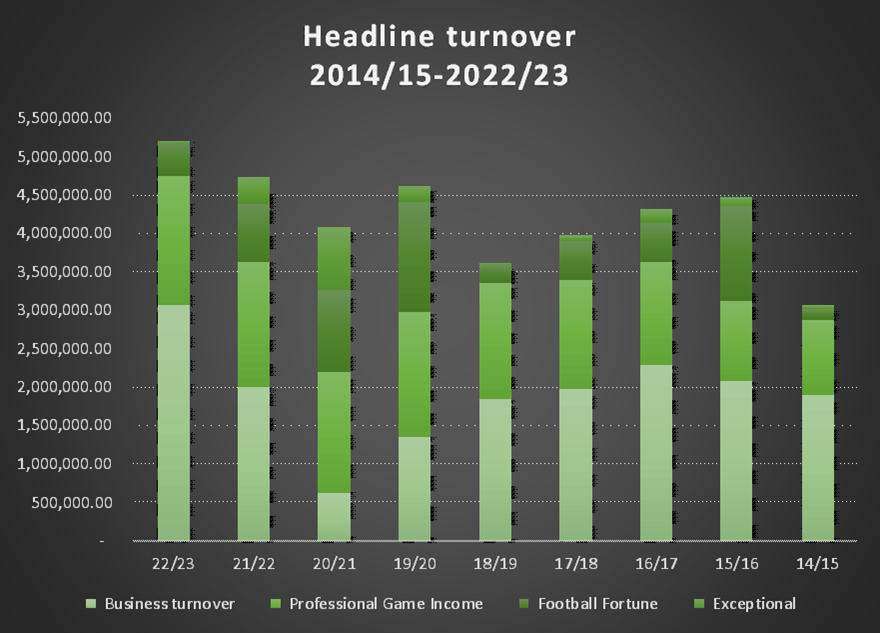

- Headline turnover: £5.29m (21/22: £4.74m). This includes recurring business income from tickets, retail and commercial, and Football Fortune from player sales, cups and play-offs and is up +11%. It is the highest in over a decade despite significant falls in player income and exceptional income.

- Business turnover: £3.06m (21/22: £1.99m). This measures the income generated by the Club’s operating activities off-the-pitch. It includes ticket, commercial and retail income. The £1.07m increase (+54% up) reflects improvement across all income streams. £3.06m is the highest Business Turnover on record. By growing recurring Business Turnover, the Sustainability of the Club is improved.

- Professional Game income £1.69m (21/22: £1.63m). This comprises EFL distribution £652,000 (2021/22: £631,000), Premier League Solidarity £480,000 (2021/22: £480,000), EPPP Academy grant income of £502,000 (2021/22: £452,000) and LFE Academy education grants £55,000 (2021/22: £70,000). Together, Business Turnover and Professional Game Income make up Recurring Income. This totalled £4.74m (2021/22: £3.62m) and was again a record high.

- Non-recurring, one-off Business turnover: £179,000 (21/22: £345,000). We earned £165,000 from the play-off semi-final in extra tickets, retail and commercial plus £14,000 of other sundry non-recurring Business Turnover. In 2021/22 this included £333,000 of one-off Coronavirus income.

- Football Fortune: £373,000 (21/22: £761,000). This comprises Football Fortune income from cup runs £120,000 (2021/22: £147,000), player sales £97,000 (2021/22: £604,000), Play-off final £110,000 and TV £46,000 (2021/22: £10,000). This was significantly down.

- Total wages & salaries costs: £3.44m (21/22: £2.93m). This is the payroll cost of all staff on and off the field, including players and football staff. The increase reflects additional planned player and football staff wages and football performance bonuses (there were no termination payments to football staff in the year).

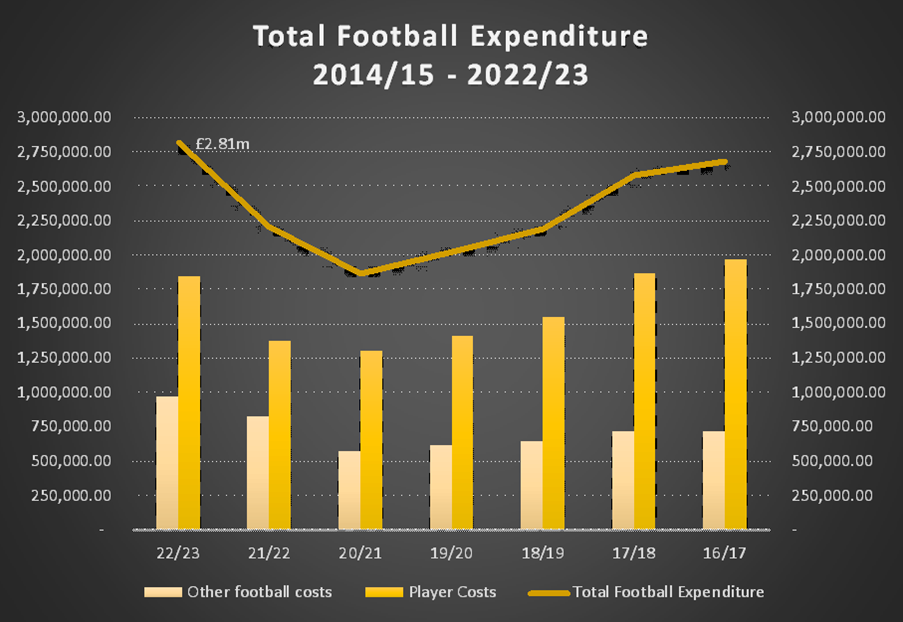

- Total Football Expenditure: £2.81m (21/22: £2.20m, 20/21: £1.87m). This includes all Player Costs and Other Football Expenditure in the first team (including travel, football IT, medical, recruitment and scouting, and all other first team football staff and coaches). It is the club’s total spending on Football. The +28% increase in Total Football Expenditure of £611,000 (2021/22 increase £332,000) helped support Paul Simpson’s plans in his first full season. It reflects higher underlying spend and football bonuses plus a reduction in other non-recurring football costs compared with 2021/22 (such as severance costs).

- Player transfer cash receipts: £176,000 (21/22: £606,000). This includes cash received from deals in 22/23 and also from prior years.

- Net assets: £8.1m (21/22: £5.4m) at 30 June 2023. This includes £11.8m attributable to stadium fixed assets. This increase reflects a revaluation in the year.

- Debtors receivable for player sales: £132,000 (21/22: £211,000) at 30 June 2022. These will be collected in 23/24 and beyond. This excludes other contingent add-on amounts or possible sell-on income, which is not certain.

- Total debt: £3.03m (21/22: £3.16m) at 30 June 2023. No new debt advances or debt repayments were made to Purepay Retail but significantly higher interest charges of £148,000 were accrued (21/22: £81,000). The Pioneer Food Group debt reduced by £32,000 in the year (21/22: change £nil). The overall £126,000 reduction in the year comprises additional accrued Purepay Retail interest less debt repayments to the EFL, settlement of a property mortgage, Pioneer debt change and the overdraft reduction.

- Football Net Debt £1.29m (21/22: £1.26m) This is an indicator used by UEFA to measure financial risk. It is Total debt less cash balances borrowings plus transfer creditors less cash less transfer debtors receivable.

- The Audited Annual Accounts for the year ended 30 June 2023 have been approved and lodged and will be available from Companies House shortly. We have also made them available here on the official website so that fans can see the information, if they wish to do so.

KPIs 22/23

- Headline turnover £5.29m +11%

- Business income £3.06m +54%

- Underlying contribution £2.15m +40%

- Wages & salaries £3.44m +18%

- Player transfer income £97,000

- Player additions £78,000

- Wages % income 65%

- Operating loss £517,000

- Overall loss £665,000

- Cash £1.59m

- Total debt £3.03m

Click HERE to download the full accounts and detailed explanation.

+++++++

Year ended 30 June 2023

Chief Executive Nigel Clibbens said: “The filing of the Audited Annual Accounts for 22/23 and detail being made public now is very much historic. However, the key financial headlines have already been shared in detailed financial updates given to fans since June 2023 HERE.

“The 22/23 financial results report a loss for the first time in recent years (which is low in the context of other L2 club’s) and shows us in a sound position day-to-day at that point. With £1.6m of cash in the bank, despite no external funding since May 2019, we had no creditor pressure and all our PAYE and VAT liabilities were paid up in full and on time. The underlying trading of the club was record-breaking as Business Turnover increased +54%. Crowds were the best in many years as fans responded to success on the pitch.

"However, despite this good news, with £2.56m of debt repayable on demand, and severe uncertainty arising from the continuing lack of confirmation that Purepay Retail would not just demand immediate repayment in full at any moment, both put the club in a very high-risk position during 22/23 and heading into 23/24. We were also experiencing rapidly accelerating interest charges on this debt. The breakdown in relations with Purepay and a key stakeholder after the changes in February 2022 all meant the future of the club was at risk, without the debt being addressed and their involvement with the club being terminated. Attempts to bring in new ownership and investment were progressing at the year end to reach exclusivity with Castle Sports Group (“CSG”). This led to a sale of the club and transfer of control in November 2024 and the Purepay debt being resolved. As a result, the material uncertainty of the going concern of the club has now been removed.

“I said in January 2023,

“after a turbulent 21/22 season, the appointment of Paul Simpson on a long-term contract aimed to bring stability and a platform to develop the playing squad and improve football results in a sustainable way.”

“In 22/23, we implemented this approach. We increased our total expenditure on football by close to 30% as we backed Paul Simpson with the highest Player Cost budget since the play-off campaign under Keith Curle in 16/17. But again, despite this significant increase, we remained in the bottom quartile of L2 spenders. Our fantastic promotion, with this level of expenditure yet again showed what clubs spend is not a barrier to success in L2.

“Player transfer income was much reduced and cup income was again very poor. These remain crucial elements of our funding and operating model each year, even under the new ownership.

“A full and detailed explanation of 22/23 results is contained in the audited Annual Accounts along with comprehensive financial and operating information. This is part of the continuing commitment to be transparent about the club’s finances and the issues and challenges we face. This contributes to us leading the way on fan engagement and is highly valuable in allowing fans to understand their club.

23/24 current year

Income

After the year end, in the new financial year to 30 June 2024 in League 1, we are seeing the best-ever year for business trading as detailed in recent updates HERE. All departments are having their best ever years, with gates the best in nearly 50 years. This is resulting in significantly increased resources for the club. All of this extra income plus more funding was allocated into the Football department, regardless of the takeover, to continue to support the plan to improve and succeed in a sustainable manner.

Expenditure

Associated with promotion and to support the new L1 campaign, we increased our Player Cost spending for 23/24 again, after the increases in 22/23 and 21/22. We also increased spending on Other Football Costs, such as more football staff, scouting, IT, travel, hotels and promotion salary increases as we invested in football staff and operations. The overall planned increase under the prior ownership, pre-takeover was circa 50%.

After the takeover, very significant further resources were allocated straight away for the January 2024 window and the rest of 23/24, including player wages, transfer fees and other football costs. This will mean before Football Fortune from Player sales and the £2.45m debt forgiveness, the club is expected to incur a very significant and higher operating loss in 23/24, despite the record-breaking year off the field.

Financing

In advance of the sale of 90% of the shares to Castle Sports Group (“CSG”), the relationship with Purepay Retail was terminated to remove the “sword of Damocles” that was being held over the club.

CSG purchased the debt which had increased in value from the £2.1m originally lend to £2.64m. It settled at £2.45m and made immediate cash payment in full. CSG immediately ceased charging interest. This means we have no interest charges in 23/24 (saving circa £200,000 on the charges we otherwise faced). The £2.45m debt to CSG is also to be waived in 23/24.

The takeover in November 2023 injected £1.35m of new equity into the club to bolster its already sound day to day position and provide immediate funding to address the backlog of capital investment and fund more resources for football.

Finally, transfers of James Trafford and Dean Henderson in the Summer 2023 window and emerging success of Jarrad Branthwaite will result in significant Player income in 23/24 of at least £1.1m. Cash will inflow over longer period.

All these changes have transformed the finances of the club to improve both the short term and its prospects for the long term.